PRODUCT LIABILITY INSURANCE

If someone is injured because of using or consuming a defective product, they may have the right to sue for damages.

What is this type of insurance?

Product Liability Insurance covers you if are a manufacturer, importer or trader for compensation you will have to pay to consumers for bodily harm and/or material damage caused by the use of any defective products you have sold them, modified, installed or you have processed in connection with the conduct of your work.

Product Liability Insurance provides protection to the insured for bodily injury or property damage caused to third parties by products, after leaving the insured and therefore will not have any opportunity to exercise any form of control or supervision over these products.

Horror Scenarios

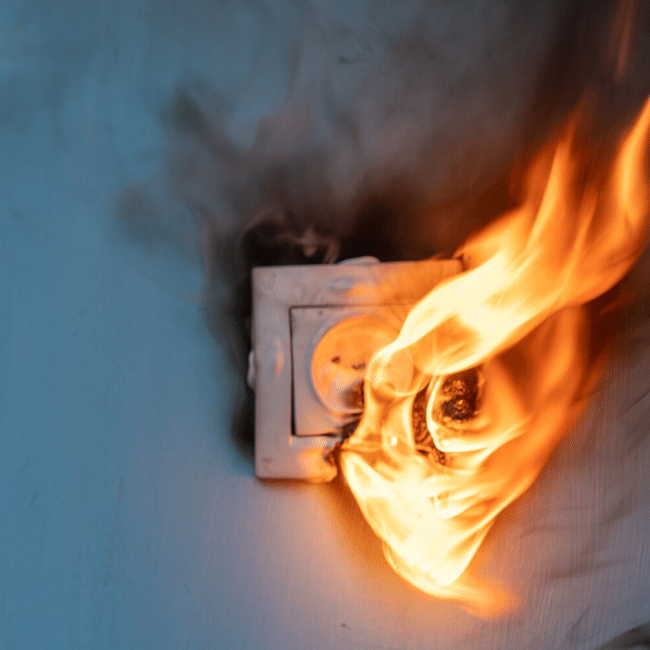

1. You are a commercial store, and you have sold a power strip and a customer informs you that the power strip has overheated and completely burned his house and demands that you pay him the damage.

2. You are a shop owner, and you sold a bicycle and the brakes did not work and a person was killed, and his family sues you.

3. You have prepared food in a restaurant and a customer has been poisoned and is asking for compensation, and your insurance against third parties does not extend to food poisoning.

4. You are a hairdresser, or a supermarket and you have sold a hair color and it has caused a serious allergy to a consumer and he is suing you.

5. You are a shop owner and you sold a toy for a small baby, and the parents are suing you because they claim that you did not have the proper marking and the baby was injured.

Who is Legally Responsible?

The legal liability for compensation to third parties may be considered be the responsibility of:

- The producer of any raw material, or part of a product

- The manufacturer of a final product or even a component of the product.

- The importer of the product

- Any person who puts a product onto the market whose producer or importer cannot be identified.

What is insured?

The legal liability of the insured for the payment of compensation to other persons in relation to:

1. Accidental bodily injury or death from an accident or illness

2. Accidental loss or damage to their property caused by, and related to, the production or disposal of, on the market, for consumption or use, of defective products in the context of its commercial activity.

If the plaintiff proves that the insured is guilty, then the following amounts are paid:

1. The legal costs of defense and expenses incurred with the written consent of the company in relation to the defense, investigation, or settlement of the claim

2. The awarded amount of compensation that the claimant is entitled to recover from the insured.

Target Audience

- Product importers

- Product manufacturers

- Product Distributors / Suppliers

- Product sellers (kiosks, shops)

- Stores (wholesale and retail)

- Businesses that sell products

- Restaurants, hotels

- Medical Centers with diagnostic machines

- Aesthetic institutes and hair saloons

What a consumer can claim?

The damages that one can claim in case of injury from a defective product are like the damages that one can claim in case of accidents resulting from negligence. In other words, they include any financial loss resulting from the accident such as, among other things, loss of salary and income, any consequent costs, and compensation for pain, suffering or a reduction in the quality of life of the injured.

Information on dangerous products:

In Cyprus, the Competition and Consumer Protection Service of the Ministry of Energy, Trade, Industry and Tourism, systematically informs consumers about products that pose a risk to their health and safety by notifying announcements in the GRAS-RAPEX System. These products are located either in Cyprus or in the markets of various Member States of the European Union and are then notified to the GRAS – RAPEX System. Consumers can be informed about the dangerous products on the website of the Competition Service at www.mcit.gov.cy/ccps or the website of the European Commission at www.ec.europa.eu/rapex

Clarification

The information above may vary from Insurance Company to Insurance Company. Depending on the Insurance plan we will propose, we will give you all the relevant information required by the legislation so you can make your decision. Ask us today for an offer and, we will choose the most suitable package for your needs and budget.